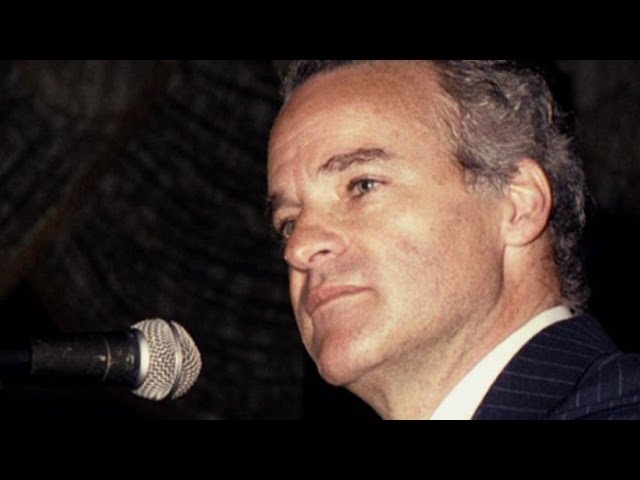

In the riveting exploration of the world of finance, we delve into the life and career of Henry Kravis, an American billionaire and co-founder of the renowned private equity firm, Kohlberg Kravis Roberts & Co. (KKR). This documentary takes us behind the scenes to unravel the enigma that is Henry Kravis, as we hear from business magnates and Wall Street heavyweights who provide valuable insights into the man who rocked Wall Street.

Henry Kravis, known for his immense wealth and his preference for privacy, declined to appear in the program. Instead, the filmmakers turn to those who have crossed paths with Kravis, including his peers and competitors, to shed light on his incredible impact on the financial world. Considered an icon in the industry, Kravis has played a pivotal role in shaping the private equity landscape, and this film offers a compelling account of his journey.

Born into privilege as the son of a successful petroleum engineer, Kravis followed in his father’s footsteps and excelled in his own right. Armed with an economics education and a move to New York in the 1960s, Kravis honed his financial skills through internships and pursued an MBA at Columbia University. It was during his tenure at Bear Stearns that Kravis, alongside his cousin George Roberts, made a name for themselves by pioneering a strategy known as “bootstrapping,” which has since become synonymous with leveraged buyouts.

Kravis’s exceptional talent, shrewdness, and audacity quickly propelled him to success, earning him partner status at Bear Stearns before the age of 30. In the mid-1970s, Kravis, Roberts, and their mentor Jerry Kohlberg departed from Bear Stearns to establish their own firm, KKR Investments, with a continued focus on bootstrap acquisitions. Armed with his track record of success, Kravis successfully garnered investor support and catapulted the company’s growth with the landmark $106 million buyout of Houdaille Automotive.

As KKR expanded, so did Kravis’s fortune, transforming him into a multimillionaire. The firm’s most notable achievement came in the late 1980s when they orchestrated the leveraged buyout of RJR Nabisco, a battle immortalized in the book “Barbarians at the Gate.” The fierce rivalry between Kravis and Nabisco CEO F. Ross Johnson captivated the public’s attention as the two engaged in a high-stakes bidding war, with Johnson ultimately succumbing to Kravis’s strategic prowess.

While the documentary offers only glimpses into Kravis’s personal life and personality, it meticulously examines his reputation as a cunning businessman and financial titan. We witness Kravis navigating through obstacles, including the bankruptcy of certain holdings and personal tragedies, such as the loss of his teenage son. Yet, amidst the challenges, Kravis remains a force to be reckoned with, continually increasing profits and solidifying his position as an aggressive and highly effective dealmaker with a billion-dollar empire to his name.

“How a Financial Titan Shaped Wall Street: The Unveiling of Henry Kravis” provides a fascinating journey into the life and accomplishments of a man who has left an indelible mark on the financial world. Through compelling interviews and expert analysis, we gain a deeper understanding of Kravis’s strategic brilliance and his enduring legacy. This documentary is a must-watch for anyone intrigued by the intricate machinations of high finance and the individuals who wield immense power in shaping our economic landscape.